I love libraries, and the local ones are a big part of my life. If anyone of my friends that work there were to lose a job if Question 1 passes, I would feel horrible and I'd write a check for at least $100 to the Forbes Library and encourage everyone I know to do the same with their local library. (This betrays my ignorance of the library's budget but I'm looking for solutions and floating ideas. WFCR sure gets a lot of donations. Why not the Forbes, or Jones?) So for that reason I will probably vote no, until such time as a local measure is put in place that would keep money here in the Valley that would normally go to Boston, much of it to be laundered and squandered. The schools and other core services, like libraries, are said to be the first things that would suffer. This pisses me off. If schools and the like are first to be cut, the state government's priorities are self-serving, not constituent serving. Nevertheless, a yes vote takes an idealistic look at what's actually happening and presumes one step backward, two forward.

I love libraries, and the local ones are a big part of my life. If anyone of my friends that work there were to lose a job if Question 1 passes, I would feel horrible and I'd write a check for at least $100 to the Forbes Library and encourage everyone I know to do the same with their local library. (This betrays my ignorance of the library's budget but I'm looking for solutions and floating ideas. WFCR sure gets a lot of donations. Why not the Forbes, or Jones?) So for that reason I will probably vote no, until such time as a local measure is put in place that would keep money here in the Valley that would normally go to Boston, much of it to be laundered and squandered. The schools and other core services, like libraries, are said to be the first things that would suffer. This pisses me off. If schools and the like are first to be cut, the state government's priorities are self-serving, not constituent serving. Nevertheless, a yes vote takes an idealistic look at what's actually happening and presumes one step backward, two forward.  While the short term effects of this ballot measure passing may be unacceptable, that's arguably the point. The checks and balances on state tax dollars is out of whack, and only if the flow of guaranteed dollars is cut off will the state, at the demand of the communities of voters that feel enough pain to complain, have to make responsible choices. The money that flows to Boston enables reckless spending and cronyism. Shirley Kressel puts it more thoroughly:

While the short term effects of this ballot measure passing may be unacceptable, that's arguably the point. The checks and balances on state tax dollars is out of whack, and only if the flow of guaranteed dollars is cut off will the state, at the demand of the communities of voters that feel enough pain to complain, have to make responsible choices. The money that flows to Boston enables reckless spending and cronyism. Shirley Kressel puts it more thoroughly:Why This Liberal Supports Repealing the Income Tax

by Shirley Kressel MySouthEnd.com Wednesday Oct 22, 2008

I am a card-carrying, unrepentant, far-left goody-two shoes bleeding

heart liberal. Radical, even.

Yet I plan to vote for Q1.

I am not a "small government" advocate. Nor is my aim to keep a few thousand more dollars in the taxpayers' pockets because "times are tough." Nor do I claim that taxpayers "know how to spend that money better than the government does." Nor do I believe we should force poor people to "pull themselves up by their own bootstraps."

My motives are the reverse. I think our government is too small for the services we need, and must be funded to do all the socially necessary things individuals, and the so-called "free markets," cannot do. But without some big change, we won't get the government we need, no matter how much money we put into it.

In fact, I believe the state is awash in money. The endless media revelations (and we can hardly imagine what's not being exposed) of waste, fraud and abuse ("WFA") show how much of our money our officials can throw away and still stay in office. Uncontrolled Big Dig costs. Billions in corporate welfare ("business incentives"), with no accounting, never mind disclosure, of how much they cost us and what they yield. Public land giveaways to developers.

In fact, I believe the state is awash in money. The endless media revelations (and we can hardly imagine what's not being exposed) of waste, fraud and abuse ("WFA") show how much of our money our officials can throw away and still stay in office. Uncontrolled Big Dig costs. Billions in corporate welfare ("business incentives"), with no accounting, never mind disclosure, of how much they cost us and what they yield. Public land giveaways to developers. Shameless retirement- pay abuse, even after exposure. Cronyism in contracts, earmarks, and hiring. A growing hack-ocracy. One hundred fifty million dollars to a business lobby called the Greenway "Conservancy" for work that cost $12 million. One hundred million dollars a year to the film industry, although everyone knows it does nothing for economic development (It's just a "fun thing," one high-level official explained to me). The I-Cubed program, giving $250 million to mega-developers for construction loans on their "public infrastructure" - like parking garages. And so on.

Shameless retirement- pay abuse, even after exposure. Cronyism in contracts, earmarks, and hiring. A growing hack-ocracy. One hundred fifty million dollars to a business lobby called the Greenway "Conservancy" for work that cost $12 million. One hundred million dollars a year to the film industry, although everyone knows it does nothing for economic development (It's just a "fun thing," one high-level official explained to me). The I-Cubed program, giving $250 million to mega-developers for construction loans on their "public infrastructure" - like parking garages. And so on.And this barely scratches the surface. I can't vouch for the Q1 supporters' opinion survey claiming 41 percent of our money is wasted - but I wouldn't be shocked if a study confirmed it.

How do they get away with it, when we're so "strapped" for money?

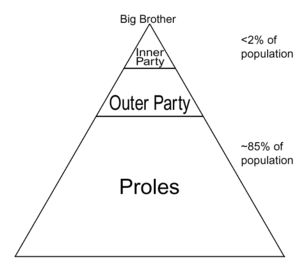

They collect vast pools of taxes without regard to documented needs, so they can burn huge amounts of money on WFA and still provide enough - just enough - public services to prevent open revolt.

Now there's another crisis and the cuts have started. Of course, the first things to go are the services to the blind, the elderly, police and parks. That'll teach you to cut taxes!

We are told that Q1 is risky. We hear that our state credit rating could fall. We hear that local aid will be cut, and local property taxes will go up. We hear that the most urgently needed human and infrastructure services will suffer most. Well, that's the point. These needs are at the bottom of the legislature's priority list. Not every legislator's list, but this legislature as a whole. And that will be true no matter how much we give them in taxes: genuine public services will get crumbs. So we have to send a message that we're not going to tolerate this outrageous misuse of our money any longer.

We are told that Q1 is risky. We hear that our state credit rating could fall. We hear that local aid will be cut, and local property taxes will go up. We hear that the most urgently needed human and infrastructure services will suffer most. Well, that's the point. These needs are at the bottom of the legislature's priority list. Not every legislator's list, but this legislature as a whole. And that will be true no matter how much we give them in taxes: genuine public services will get crumbs. So we have to send a message that we're not going to tolerate this outrageous misuse of our money any longer.But, we're told if we want to send a message, do it another way.

I spend most of my time trying to send messages to politicians. I do research, I send letters, I beg for meetings with even the lowliest of staff ("Oh, please, sir, just a few minutes of your time...."). I just can't think of any other ways to send a message.

Except to throw da bums out. And to do that, we need to know who da bums are. And to do that, we need information we don't have and can't get.

Except to throw da bums out. And to do that, we need to know who da bums are. And to do that, we need information we don't have and can't get.I think the only way to get our money directed to our real public needs is to cut the cash pipeline and force politicians to make choices - in public view. Poor children or wealthy corporations: let's see what they do when they can't serve both, and throw out da ones who choose wrong.

Shirley Kressel is a landscape architect and urban designer, and one of the founders of the Alliance of Boston Neighborhoods.

P.S. Here is another piece on the issue. A video on the "hidden budget"

And one from Commonwealth Magazine.

.jpg)

1 comment:

MassINC has done the research.

"Since 1987, the share of total state spending that occurs outside the annual budget has increased from 20 percent to almost 33 percent, creating confusion and a lack of transparency. In FY 2006, the state's budget was $25.6 billion, but total state spending was $37.5 billion. There is not consistency regarding what spending is on-budget and what is off-budget. In recent years, some spending for health care, employee pensions, public transit, and school construction has been removed from the state's annual budget."

http://www.massinc.org/fileadmin/researchreports/budget_brief/budget_brief_full.pdf

http://www.massinc.org/fileadmin/researchreports/budget_brief/budget_brief_key_findings.pdf

Post a Comment