Gambling Insurance, Not Health Insurance would be an accurate Republican campaign slogan. The editorial by Michael Hudson (at bottom) is the best I've read yet with respect to understanding what looks like another major public swindle. I've read plenty of articles in the WSJ and The Economist which illuminate the situation, but they come from a place of acceptance in the process in general. They analyze the path of the money like a general would assess and plan troop movements, never questioning whether the battle or the war itself might be corrupt to begin with.

Gambling Insurance, Not Health Insurance would be an accurate Republican campaign slogan. The editorial by Michael Hudson (at bottom) is the best I've read yet with respect to understanding what looks like another major public swindle. I've read plenty of articles in the WSJ and The Economist which illuminate the situation, but they come from a place of acceptance in the process in general. They analyze the path of the money like a general would assess and plan troop movements, never questioning whether the battle or the war itself might be corrupt to begin with.

Hank Paulson made the Sunday morning rounds on TV trying to "sell" and push through through an immediate bail-out with no intention of building in some elements accountability. He was using typical government scare tactics, which I hope will be seen as such. "The credit markets are still very fragile right now and frozen," Paulson said in an interview on NBC's Meet the Press. "We need to deal with this and deal with it quickly. It pains me tremendously to have the American taxpayer put in this position but it is better than the alternative." The Paulson bailout proposal is a historic swindle. It provides the most help to the financial institutions that made the worst investment decisions, ignores relief to homeowners, and fails to limit CEO compensation. BUSHCO needs to explain why this is supposed to work - not try to steamroll Congress into giving it a blank check.

Democrats said they understood the need for urgency but insisted that the measure needed to provide help for homeowners threatened with losing their homes, perhaps by changes in bankruptcy laws (which the Bush Admin. made far stricter a few years ago) to allow for mortgages to be modified, and by capping pay and benefit packages for executives at the huge Wall Street firms that will be selling their bad debt to the government. How about that, huh? Maybe the culprits should sacrifice some of their luxuries in exchange for a magic wand -load of the citizens tax money.

"This would be the most serious financial crisis that the world has ever dealt with. It is not a time to be playing games," said House Republican Leader John Boehner.

What an asshole. These "games," John, would be to protect our livelihood. We need houses on Baltic Ave., not more hotels in Marvin Gardens. Personally, I'm suspicious of any far-reaching policy that gets rammed through because of an "emergency," preventing even a basic checks and balances vetting. We've seen how that goes.

Michael Hudson doesn't shy away from being candid about the emperor's new clothes.

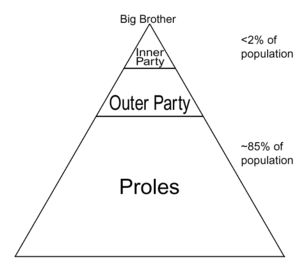

America's Own Kleptocracy

By Michael Hudson

20/09/08 "Global Research" -- - Nobody expected industrial capitalism to end up like this. Nobody even saw it evolving in this direction. I'm afraid this failing is not unusual among futurists: The natural tendency is to think about how economies can best grow and evolve, not how it can be untracked. But an unforeseen road always seems to appear, and there goes society goes off on a tangent. What a two weeks! Continues here.

and here is the relevant New York Times story.

.jpg)

No comments:

Post a Comment